Show the reference number for the shipment and name of the carrier moving the shipment.

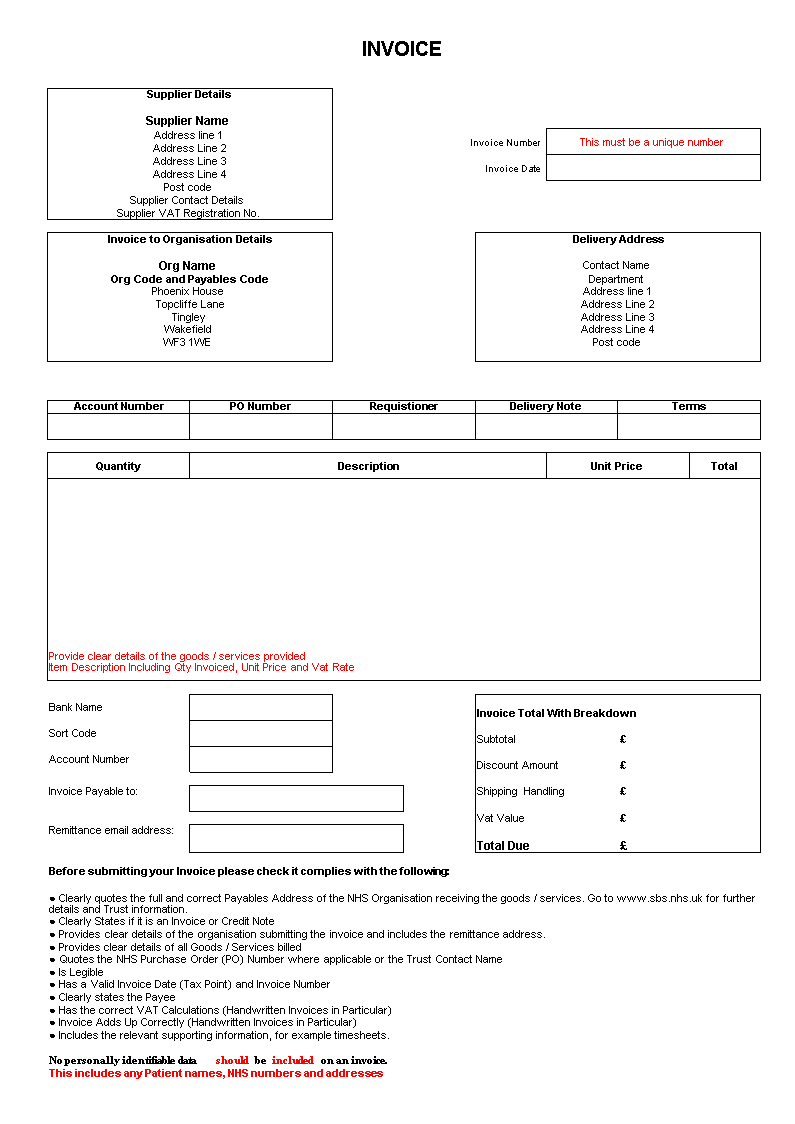

#Customs invoice pro forma promotion material no payment registration

The seller will usually also display identification reference such as their VAT registration number and or company number.Ī “ Proforma Invoice” is a document provided for customs purposes only, it explains all the information that a commercial invoice does, except that it is for contents that have not been sold. If the shipment has a value of over £100 a commodity code for the contents should also be on the invoice, to allow customs to easily and correctly identify the contents. The commercial invoice will have an invoice number, for the sale of the goods and provide information on the seller and the buyer of the goods. You should supply a “ Commercial Invoice” with your shipment when: It enables the shipment to be correctly assessed by a customs officer from the destination Country. Sending an invoice with an international shipment allows the customs office to understand:Ģ. The contents and value of the shipment. For further information on when duty and taxes are due, please have a look at this article click here. They will assess it for any import duty and or taxes that might be due for allowing it into the Country. When you are sending a non–document outside of the European Union, of EFTA countries, the shipment has to be submitted to the destinations customs department.

0 kommentar(er)

0 kommentar(er)